Last Updated on by Adam Rosenblum Esq.

It’s difficult enough for most drivers to get good auto insurance rates without constantly changing insurance companies every few years, but a new study from the Consumer Federation of America (CFA) shows that this challenge adversely affects Americans with lower incomes.

CFA sought quotes for men and women in 15 cities across the US from the nation’s five largest car insurers: Geico, Progressive, Allstate, Farmers, and State Farm. The study first took quotes for drivers whose occupation was listed as either a manufacturing executive or a bank executive across 15 different ZIP codes. The process was then repeated using the same address and replacing the job title with a factory position or bank teller. While annual income was not directly considered, factors that often indicate income level — such as education, homeownership, and marital status — were taken into account.

CFA found that drivers with likely higher socioeconomic standing paid an average of just over $1,140, while those with lower economic status received an average quote of $1,825. GEICO charged the largest average percentage increase at 92% and Progressive had the second largest disparity, charging lower-income drivers 80% more. State Farm charged the smallest increase to lower-income drivers at 13%, but CFA noted that State Farm also includes credit scores in the final price, a factor that also disproportionately impacts lower-income drivers.

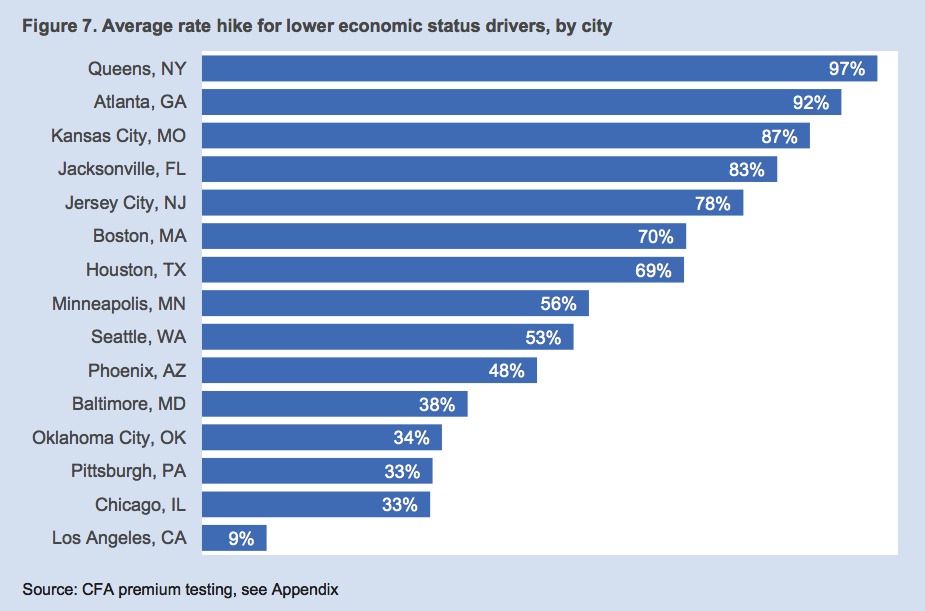

The exact increase varied by region. Queens County, NY saw the largest disparity, with low-income drivers paying 97% more while Los Angeles, CA had the lowest average difference with only a 9% difference.

Out of 280 drivers used in the study, there were 21 instances in which a company would not provide a quote to a lower-income driver, though those same companies offered quotes to the higher-income driver at the same address. Allstate rejected 13 applicants, State Farm refused quotes for 5, and Farmers denied 3. None of the high-income drivers were denied a quote.

As part of the study, CFA commissioned ORC International to survey 1,000 Americans about the use of various rating factors to determine auto insurance premiums. Eighty-three percent found it very fair or somewhat fair for auto insurers to consider traffic accidents and 84% said it was very or somewhat fair to use moving violations such as speeding tickets. However, the near opposite was true for non-driving related factors that reflect drivers’ economic status, including credit scores (only 38% said it was fair), homeownership (36%), occupation (35%), and level of education (30%).

In all cases, test subjects indicated a clean driving record. That’s likely because even minor traffic citations, including speeding and red-light violations, can cause insurance premiums to skyrocket.

If you or a loved one has been ticketed for speeding or any other traffic violation, call us to fight the ticket and avoid costly insurance premium increases. Adam H. Rosenblum of the Rosenblum Law Firm is a skilled New York traffic ticket attorney who is experienced in handling tickets for speeding as well as other driving-related offenses. Call 888-203-2619 or email the Rosenblum Law Firm today for a free consultation about your case.

As the founding attorney of Rosenblum Law, Adam has built a firm that prioritizes client success and legal excellence. His leadership and vision have established Rosenblum Law as a premier legal practice for traffic and criminal defense, ensuring that clients receive the highest level of advocacy and support.